INTRODUCTION

The NASDAQ Stock Market defines bubble economics as a specific circumstance in market economics where asset prices rise to a level considerably higher than the intrinsic worth of that asset.

To put it simply bubble economics is a term used to refer to a specific situation in the economy where assets are valued at improbable and volatile rates on the basis of speculation and assumed asset value. It arises from a situation where investors believe that something that they are investing in potentially has a much greater value than what it actually does.

Eventually people start spreading tales of success through investment in that sector. This makes stock in companies or firms in that sector much more lucrative which results in many people following the trend and investing in these firms, expecting a high level of returns. Since the prices are entirely speculative, once the “bubble” continuously grows it reaches a breaking point where it is no longer sustainable. Then the stock market crashes in an event known as the bursting of the bubble.

At this point the economy can go into a recession and it can branch out and affect multiple sectors of the population whether they were directly involved in it or not.An economic bubble is generally considered as being bad for the economy. They were even predicted by the Austrian School of Economics who had predicted that too much lending because of lower interest rates would lead to an economic bubble.They also forecast over a 100 years ago that these bubbles would burst causing an economic crisis.

There have been many well known cases of economic bubbles in the world economy such as the United States real estate bubble in 2007, the Asian Financial Crisis in 1997, the Poseidon Bubble in 1970,etc. The dot com bubble is also such an economic bubble which took place in the 1990s, starting in 1995 and going on till around 2002 with much of its impacts still being felt to this day.

CAUSES AND EVENTS

The first cause of the dot com bubble also known as the internet bubble was the Taxpayer Relief Act of 1997. It was legislature aimed towards the middle class income group and contained multiple tax reforms, the key one being that the tax returns on capital gains was lowered from 28% to 20%. This in a very simplified sense resulted in lower dividend paying stocks providing greater returns as compared to the higher dividend paying stocks.

Now with the advent of the Internet and its wide range of uses and its immense reach, multiple companies started popping up which made full use of the advantages of the Internet. These companies grew at a rapid rate and because of their nature, they did not have to pay a consequential amount of dividends to their shareholders. Another factor was that due to the new legislature the firms paying less dividends with capital losses had a greater return rate compared to the dividend paying companies without capital losses.

Both these factors combined to fuel the new economic crisis that was to come. Internet companies essentially became an immense speculative market where people kept investing in the expect of great returns. The companies used to run their businesses at a loss, spending a reckless amount of money on advertising to build up a brand image and goodwill. They even compromised on their profits by selling their products or services at lower rates. This again was an attempt to build up awareness about their brand name in order to capitalize on them on a future date.

What they did not realize was that this valuation on their company was purely fictional without any real assets or inventory to back it up. It was to reach a saturation point soon at which point the bubble would inevitably burst which would cause the economy to crash resulting in their stock values dropping by hundreds of dollars and eventually putting them into debt.

Multiple economists started to prophesied that the bubble was about to burst and this started to make people lose faith in their investments. The companies would soon have no money left and would definitely have to file for bankruptcy. At the same time multiple events such as the 9/11 attacks, the Enron Scandal and the exposure of fraudulent behavior of many Internet and technology based companies resulted in a fall in the goodwill of the entire sector.

This was the turning point at which the bubble burst resulting in a market recession where trillions of dollars were lost as companies lost their stock value and slowly but surely almost all of them have filed for bankruptcy or merged with other companies.

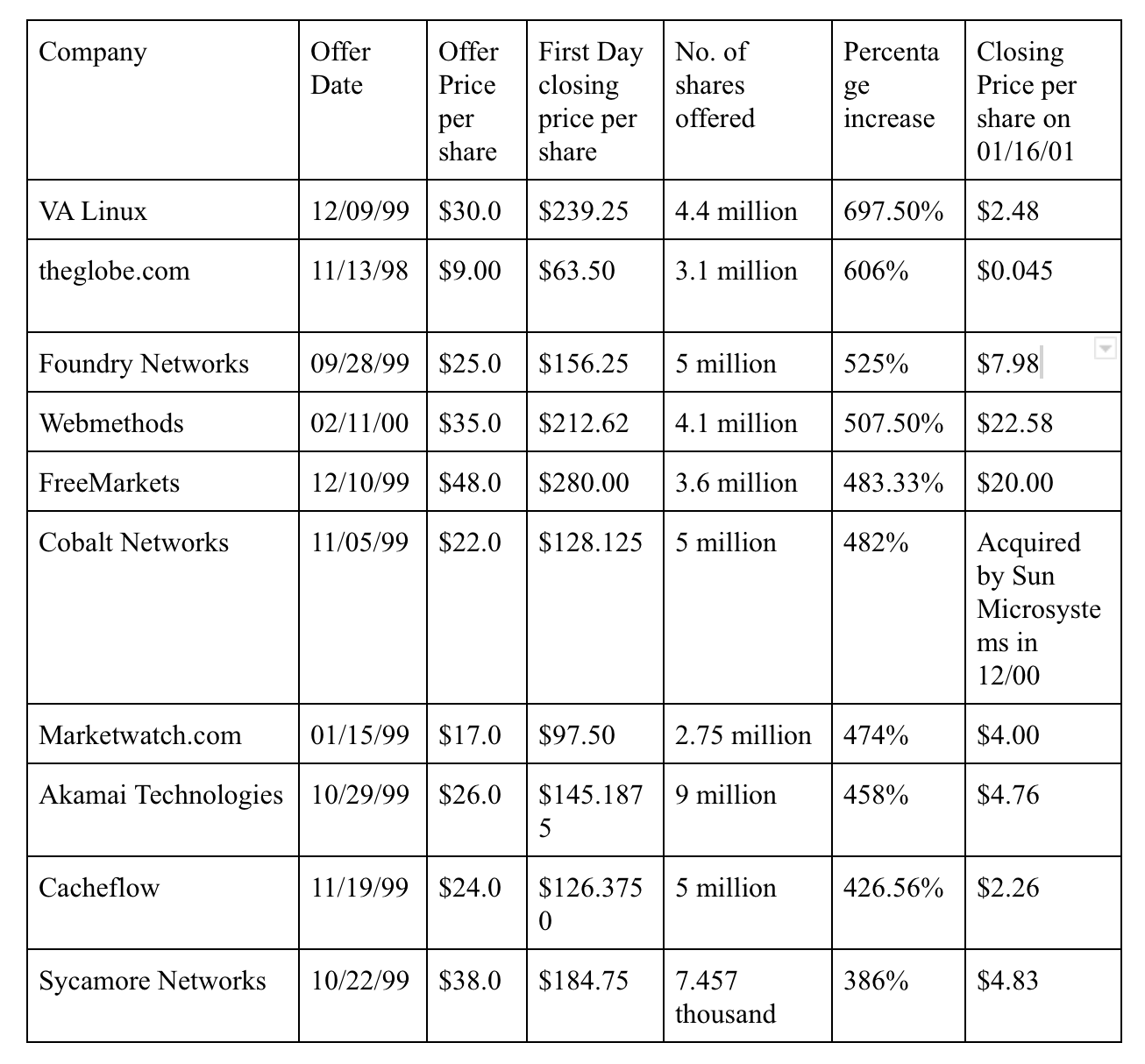

As we can see from the table above, multiple Initial Public Offerings (IPOs) which were based on Internet reliant companies had an immense rise in their initially offered price per share which happened over the course of a single day. Once the market crashed, these companies suffered tremendous losses as their price per share fell at a minimum of nearly 400%. This shows just how severe the bursting of the bubble was as it would be nearly impossible for any company to recover from such a drastic fall in stock value regardless of whether they had the necessary inventory or not. It also shows how for example some companies were acquired in their entirety by other companies along with the market crash.

IMPACT

The dot com bubble burst had a worldwide effect. Being a worldwide phenomenon it resulted in a worldwide recession with many people losing their jobs and their money. Once a company went public all the money invested in it was tangible and it affected the market negatively. Even the real estate market was affected as real estate was invested in so as to make way for the infrastructure required to run an efficient well sized Internet based company. Space was necessary to store databanks, offices, computers and other important facilities and once the economy crashed it all became useless creating a huge surplus of unused real estate.

Not all companies went bankrupt however, and those companies which survived essentially gained a monopoly over their respective sectors as they had no competition and they had gained knowledge and goodwill in the process. Companies such as Google, Amazon and eBay were some of the few to survive and they are now the biggest names in their groups having recovered from the shock from the bubble bursting and finally having capitalized on the brand name that they had been building.

The interest rate was increased on loans which prevented companies from borrowing too much money and banks from losing money by lending money to companies with a highly speculative nature.

According to a Deutsche Bank economist the stock market is still reeling from the effects of the dot com bubble. In a small time frame the economy is recovering but if we compare it using a longer time frame reference we can see how the stock market growth rate is still lower than what the average rate of growth is for that time period.

CONCLUSION

The entire concept of the bubbles in the market are based on a concept known as Venture Capitalism. It is a high risk high return form of investment that is based off of speculation and investment in up-and-coming businesses that exhibit properties of speedy growth at their initial stages of development.

When venture capitalism happens at such a large scale, the resultant loss in case of the dot com bubble would be immense as it turned out to be in the end. Many people investing in these companies were aware of this but still chose to do so because the payoff seemed too lucrative to give up. There were some positive effects however as it cleared up the online market in what can be described as a technological “black plague” that eventually gave way for new companies to start again at a slower sustainable rate ushering in an Internet Renaissance. It educated the investors in suitable investment choices.

Shrewd investors such as Mark Cuban were able to capitalize on the bubble by liquidating his investments right before the bubble burst. He was able to walk away with nearly 1.7 billion dollars after he sold his stock in Yahoo. So bubble economics in a nutshell can be considered to be similar to The Game of Thrones. When you play you either win or you die.

REFERENCES

Making Diplomatic History. (2001). Foreign Policy, (126), 98-98. Retrieved from

http://www.jstor.org/stable/3183273

Goodnight, G., & Green, S. (2010, June 16). Rhetoric, Risk, and Markets: The Dot-Com Bubble.

Retrieved from https://www.tandfonline.com/doi/pdf/10.1080/00335631003796669

Wheale, P. R., & Amin, L. H. (2010, August 25). Bursting the dot.com “Bubble’: A Case Study

in Investor Behaviour. Retrieved from https://www.tandfonline.com/doi/pdf/10.1080/0953732032000046097

Ljungqvist, A., & Wilhelm, W. (2003). IPO Pricing in the Dot-Com Bubble. The Journal of Finance,

58(2), 723-752. Retrieved from http://www.jstor.org/stable/3094556

Levine, Zajac, J., E., & Sheen S. (2007, February 01). The Institutional Nature of Price Bubbles.

Retrieved from https://papers.ssrn.com/sol3/papers.cfm?abstract_id=960178

Shiller, R. J. (2012, July 23). Bubbles without Markets. Retrieved from

https://www.project-syndicate.org/commentary/bubbles-without-markets?barrier=accesspaylog

Nordqvist, C. (2018, August 12). What is an economic bubble? Definition and causes. Retrieved

from https://marketbusinessnews.com/financial-glossary/economic-bubble/

Nordqvist, C. (2018, August 12). What is Austrian economics? Retrieved from

Definition of “Economic bubble ” – NASDAQ Financial Glossary. (n.d.). Retrieved from

https://www.nasdaq.com/investing/glossary/e/economic-bubble)

Krugman, P. (2013, May 10). Bernanke, Blower of Bubbles? Retrieved from

Vlastelica, R. (2018, January 19). Stocks are still feeling the hangover of the dot-com bubble and

the financial crisis. Retrieved from

https://www.marketwatch.com/story/stocks-are-still-feeling-the-hangover-of-the-dot-com

-bubble-and-the-financial-crisis-2017-12-06

Calculations, P. (2010, December 15). Here’s Why The Dot Com Bubble Began And Why It

Popped. Retrieved from

https://www.businessinsider.com/heres-why-the-dot-com-bubble-began-and-why-it-popped-2010-12?IR=T

Ritter, J. (n.d.). Big IPO Runups of 1975-2000. Retrieved from

https://www.pbs.org/wgbh/pages/frontline/shows/dotcon/thinking/stats.html

McCullough, B. (2018, December 04). An eye-opening look at the dot-com bubble of 2000 – and

how it shapes our lives today. Retrieved from https://ideas.ted.com/an-eye-opening-look-at-the-dot-com-bubble-of-2000-and-how-it-shapes-our-lives-today/amp/

Taxpayer Relief Act of 1997. (n.d.). Retrieved from

https://tax.findlaw.com/federal-taxes/taxpayer-relief-act-of-1997.html

Good work

LikeLike

Great work

LikeLike

Finally someone in our class writing about the dot com bubble! Venezuela is getting all the love otherwise….

LikeLike

Very good work

LikeLike